INTC 財報點評 - 股票

By Mason

at 2021-01-26T02:06

at 2021-01-26T02:06

Table of Contents

原本想比照上次MU/INTC/AMD/XLNX財報來分析誰在說謊,不過這次有點累了

加上看到這篇對岸的文章,認為蠻有料的,給各位看看.

---

Intel 2020 Q4財報點評

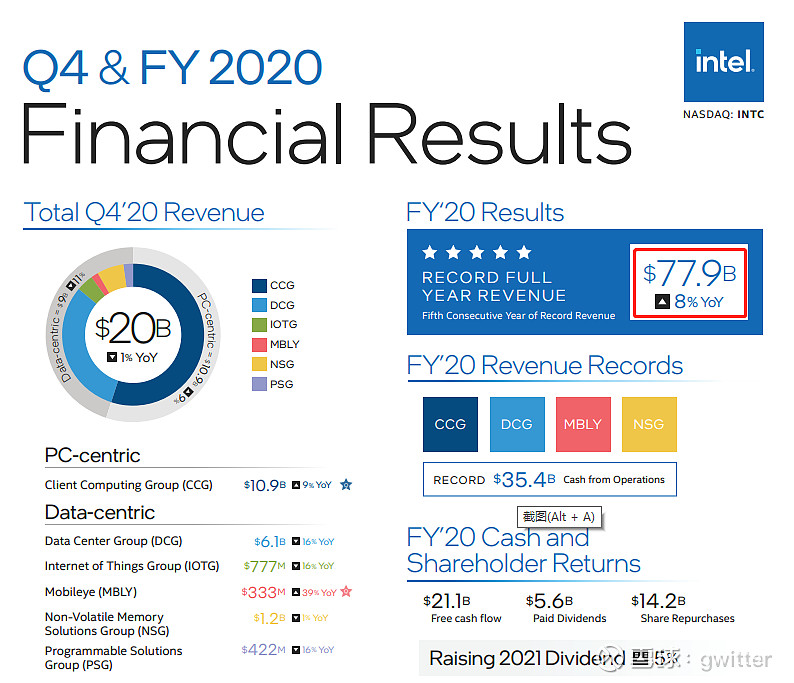

INTEL 的財報出來了,怎一個「慘」字了得? 幸虧有領導層的變化帶來了一

些希望,否則不知道Intel的股票會跌成什麼樣子,即便如此,週五還是跌去10%。更弔詭

的是,Q4財報的主要資訊(下邊這張圖)在週四交易結束前被洩露,引起 INTEL/AMD/NVDA

的股票閉市前突然向上波動。Intel得知信息洩露後,為公平起見,在交易日結束前公佈了

財報。

https://xqimg.imedao.com/1772f1712c447a333fb64fcf.png!800.jpg

下面分別就Intel財報的內容做一些點評,有理解不準確之處,歡迎網友討論。

https://xqimg.imedao.com/1772f18975747a3a3feb6e6d.png!800.jpg

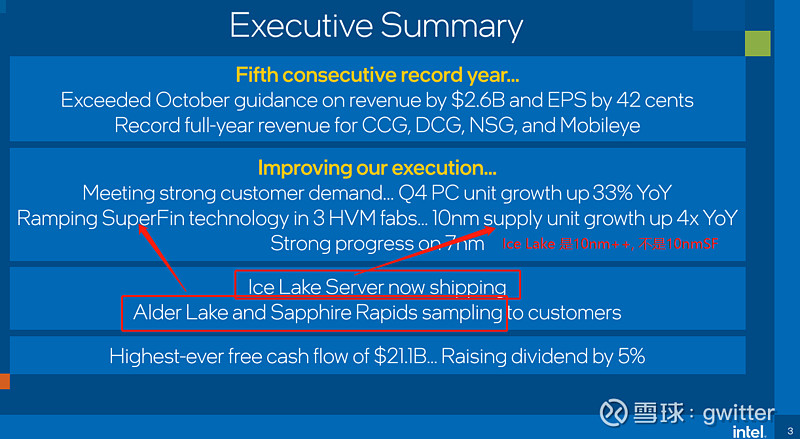

這是第3張投影片,我關心的焦點是Ice Lake-SP伺服器CPU量產的情況。

從字面表述看,產品已經開始輸送(Shipping) ,但結合上下資訊看,情況並不樂觀。

瞭解Intel 10nm節點技術發展曲折經歷的球友知道,伺服器Ice Lake-SP 的10nm製造節點

和筆記本Tiger Lake 的10nm製造節點並不相同,

Ice Lake-SP是所謂"10nm++"技術,Tiger Lake是"10nmSuper Fin"

PPT裡面說「10nm Super Fin 在3個高產工廠逐步上量」,但用「10nm 供應數量年增長4倍

」來模糊二者的區別,有欲蓋彌彰的嫌疑。關心Intel不同10nm節點技術的球友,可以參考

我這篇文章,瞭解這個區別對判斷Intel 伺服器CPU在2021/2022的市場表現十分關鍵。

https://xqimg.imedao.com/1772f218fb347be23fe5ed0a.png!800.jpg

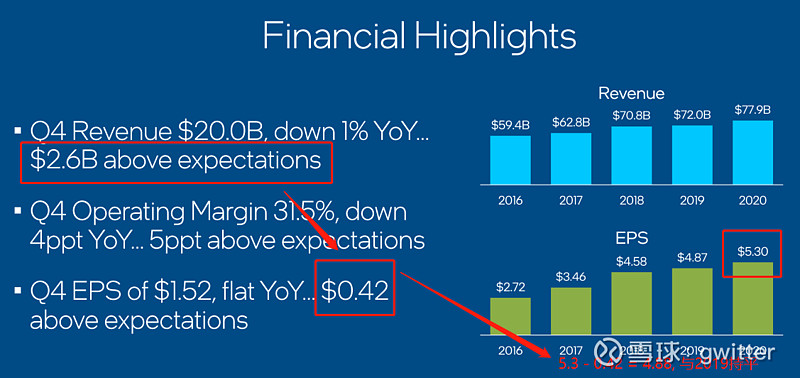

上面是第5張投影片,Q4收入超過預期26億美元! EPS超出預期0.42。

反推一下,如果沒有Q4的超預期,FYI2020的EPS是4.88,基本與2019的4.87持平。

https://xqimg.imedao.com/1772f23939d483633fe475fc.png!800.jpg

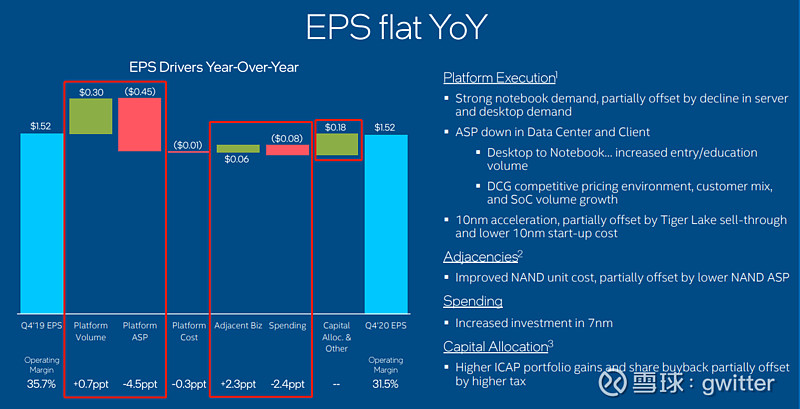

上面是第6張投影。Q4 EPS 同比持平,仔細看一下EPS貢獻組成的變化,產量提升帶來的

增長貢獻($0.30)被產品平均售價降低帶來的負增長(-$0.45)拉低,增量增收不增利

! 另外值得注意的是「Ajacent Biz」帶來的貢獻($0.06)屬於即將賣掉的NAND存儲,

也就是不可持續。而支出「Spending」貢獻的(-$0.08)來自7nm的投入,這個會持續而

且很可能加大。

原因大家看一下ASML的財報,EUV光刻機主要交付給了兩個亞洲晶片製造商台積電和三星。

北美的Intel還沒有開始大規模採購,意味著今後還需要花大錢來投資!

另外,最後一項「資本分配Capital Alloc」正面貢獻了($0.18), 底下小字注解里

說股票數量減少了,確實,第7頁PPT說過去一年Intel花了142億美金回購,減少了股票數

量。意味著沒有大手筆回購的話,EPS就不會是1.52,而是1.34。

https://xqimg.imedao.com/1772f2f78ac47d543fbd396c.png!800.jpg

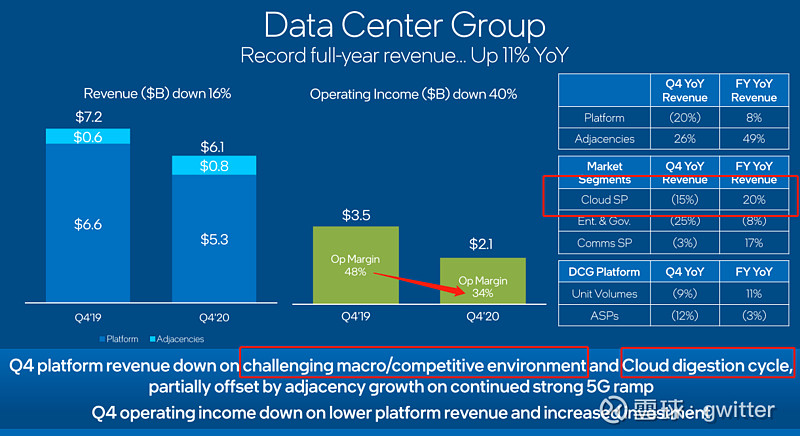

上面是第8頁。第4季的表現可以說十分糟糕! SaaS、政府和企業市場全部兩位數下滑。

政企下滑可以理解,同業基本都存在,但雲服務商下降和市場實際情況是反向的。

由於疫情影響,雲服務需求是上升,而不是下降,讓人感覺用消化週期(Digestion

Cycle)來解釋是在刻意掩蓋現實。另外,運營獲利率從48%下降到34%,這對傳統的高利

潤DCG數據中心業務來說是不可想像的,過去被認為利潤低的CCG部門,營業利潤率是41%

https://xqimg.imedao.com/1772f367a3947b2b3fac6c47.png!800.jpg

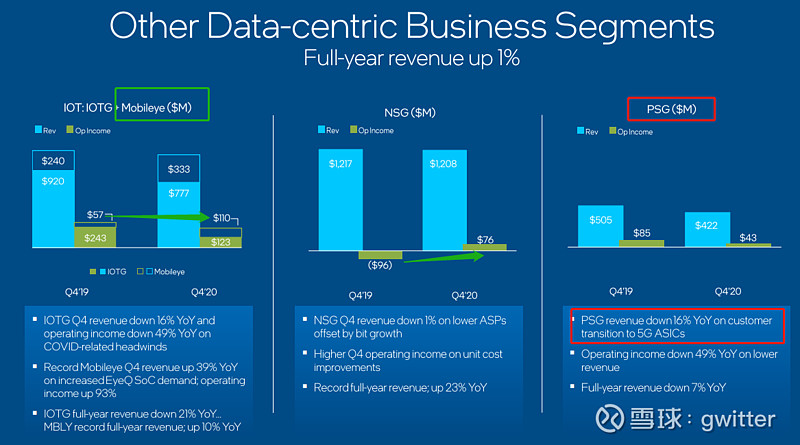

上面是第9張。DCG其它業務看著還行,特別是與自動駕駛有關的MobilEye表現亮眼。PSG

的表現不佳,銷售額和利潤都在下滑,解釋原因是5G設備商逐漸不使用FPGA而開始使用自

己研發的ASIC。是否如此? 下週1月26日我們看看賽靈思XLNX的財報就知道了

https://xqimg.imedao.com/1772f398f7f47a073fd43aca.png!800.jpg

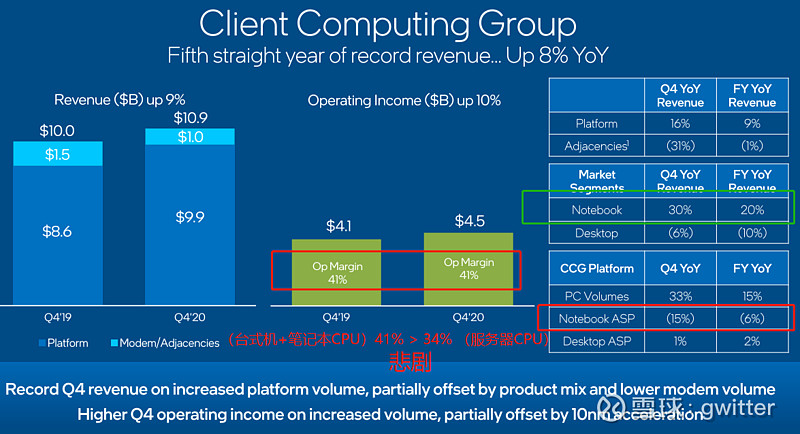

上面是第10頁 CCG的業務情況,業務收入在筆記本市場表現優秀,獲得了同比30%的上升

。由於疫情引起用戶活動行為的變化,估計市場熱度還會持續一段時間。美中不足的是平

均售價同比下降了15%,反映出主要是低端產品帶來的收入。當前市場情況適合Intel的

IDM模式,產能問題不用求助於人。另外,CCG的營運獲利率41% > DCG 的34%,Intel伺服

器CPU估計現在必須要以價格取勝了,當然,不像AMD依靠台積電生產,Intel產品有貨也

是優勢

https://xqimg.imedao.com/1772f3e738247ec73fbd38b8.png!800.jpg

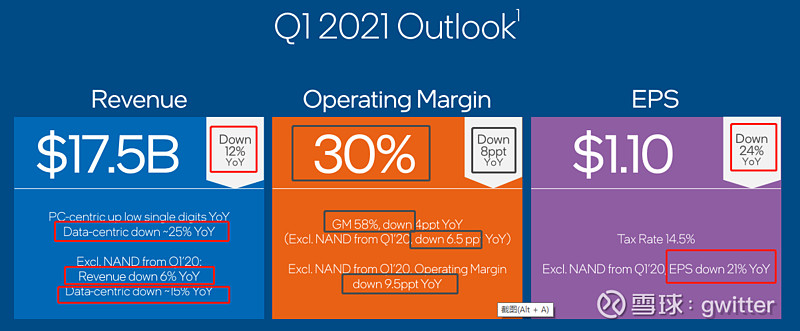

上面是第12頁,內容是對2021年Q1的展望,也應該是持有Intel股票的球友最該仔細琢磨

的,“ Down"這個單詞在頁面上出現了10次,心驚肉跳。對2021年的全年展望需要等新

CEOPat Gelsinger 在2月15日上任後才能給出。不過,2021年的產品銷售情況是18-24個

月前產品路線圖執行的結果,新CEO到來不能從根本上改變太多。Intel這艘船慣性大,好

船長開始掌舵調整航向,到能夠看到行駛正常,需要的時間是以年為單位的。AMD這艘小

船,從2014年10月開始由Lisa Su掌舵,到2019年初開始讓人看到希望,都用了4年時間,

英特爾 估計需要的時間更長! 期待新CEO能夠不再粉飾太平,而是實事求是、開誠布公

地說明經營情況,找到應對之策

作者:gwitter

https://xueqiu.com/1577178983/169682480?fbclid=IwAR2xsSbyCBjAPztV8420rlBBfkMU7k8EARrQunZw87xtsZkBWpjs0eoBzW8

--

Tags:

股票

All Comments

By Doris

at 2021-01-28T12:00

at 2021-01-28T12:00

By Connor

at 2021-02-01T03:19

at 2021-02-01T03:19

By Leila

at 2021-02-04T15:53

at 2021-02-04T15:53

By Daniel

at 2021-02-07T22:38

at 2021-02-07T22:38

By Eartha

at 2021-02-11T20:39

at 2021-02-11T20:39

By Leila

at 2021-02-15T00:31

at 2021-02-15T00:31

By Carolina Franco

at 2021-02-19T22:09

at 2021-02-19T22:09

By Candice

at 2021-02-22T15:26

at 2021-02-22T15:26

By Tom

at 2021-02-26T01:28

at 2021-02-26T01:28

By Selena

at 2021-02-28T20:44

at 2021-02-28T20:44

By Michael

at 2021-03-03T14:35

at 2021-03-03T14:35

By Selena

at 2021-03-05T12:39

at 2021-03-05T12:39

By Bethany

at 2021-03-07T02:54

at 2021-03-07T02:54

By Edith

at 2021-03-10T07:25

at 2021-03-10T07:25

By Anthony

at 2021-03-12T04:06

at 2021-03-12T04:06

By Jessica

at 2021-03-16T10:23

at 2021-03-16T10:23

By Kelly

at 2021-03-17T14:22

at 2021-03-17T14:22

By Suhail Hany

at 2021-03-21T14:04

at 2021-03-21T14:04

By Catherine

at 2021-03-22T05:41

at 2021-03-22T05:41

By Mia

at 2021-03-22T12:46

at 2021-03-22T12:46

By James

at 2021-03-23T18:08

at 2021-03-23T18:08

By Susan

at 2021-03-28T09:44

at 2021-03-28T09:44

By Susan

at 2021-03-30T22:27

at 2021-03-30T22:27

By Belly

at 2021-04-02T01:27

at 2021-04-02T01:27

By Doris

at 2021-04-03T10:34

at 2021-04-03T10:34

By Callum

at 2021-04-07T16:01

at 2021-04-07T16:01

By Oliver

at 2021-04-10T03:26

at 2021-04-10T03:26

By Todd Johnson

at 2021-04-10T17:10

at 2021-04-10T17:10

By Margaret

at 2021-04-14T22:48

at 2021-04-14T22:48

By Dora

at 2021-04-19T14:27

at 2021-04-19T14:27

By Ingrid

at 2021-04-24T01:11

at 2021-04-24T01:11

By Zenobia

at 2021-04-27T22:17

at 2021-04-27T22:17

By Damian

at 2021-05-02T06:06

at 2021-05-02T06:06

By Xanthe

at 2021-05-05T23:22

at 2021-05-05T23:22

By Daniel

at 2021-05-09T08:01

at 2021-05-09T08:01

By Andy

at 2021-05-11T02:55

at 2021-05-11T02:55

By Susan

at 2021-05-12T22:31

at 2021-05-12T22:31

By Olivia

at 2021-05-16T16:47

at 2021-05-16T16:47

By Rachel

at 2021-05-19T08:01

at 2021-05-19T08:01

By Rachel

at 2021-05-23T16:00

at 2021-05-23T16:00

By Daph Bay

at 2021-05-25T07:13

at 2021-05-25T07:13

By Kama

at 2021-05-27T14:26

at 2021-05-27T14:26

By Faithe

at 2021-05-29T21:51

at 2021-05-29T21:51

By Faithe

at 2021-05-31T04:05

at 2021-05-31T04:05

By Ina

at 2021-06-03T07:58

at 2021-06-03T07:58

By Ula

at 2021-06-03T21:30

at 2021-06-03T21:30

By Barb Cronin

at 2021-06-06T13:00

at 2021-06-06T13:00

By David

at 2021-06-09T21:32

at 2021-06-09T21:32

By Xanthe

at 2021-06-14T17:35

at 2021-06-14T17:35

By Annie

at 2021-06-16T08:25

at 2021-06-16T08:25

By Skylar DavisLinda

at 2021-06-19T09:06

at 2021-06-19T09:06

By Lauren

at 2021-06-23T18:51

at 2021-06-23T18:51

By Joseph

at 2021-06-26T09:46

at 2021-06-26T09:46

By Charlotte

at 2021-06-28T03:40

at 2021-06-28T03:40

By Eden

at 2021-07-02T05:33

at 2021-07-02T05:33

By Hedy

at 2021-07-02T15:02

at 2021-07-02T15:02

By Joseph

at 2021-07-04T00:17

at 2021-07-04T00:17

By Ida

at 2021-07-05T19:22

at 2021-07-05T19:22

By Connor

at 2021-07-10T05:33

at 2021-07-10T05:33

By Ethan

at 2021-07-12T03:42

at 2021-07-12T03:42

By Todd Johnson

at 2021-07-13T16:41

at 2021-07-13T16:41

By Poppy

at 2021-07-18T07:59

at 2021-07-18T07:59

By Hazel

at 2021-07-19T17:16

at 2021-07-19T17:16

By Poppy

at 2021-07-23T11:00

at 2021-07-23T11:00

By Hardy

at 2021-07-24T21:00

at 2021-07-24T21:00

By Lucy

at 2021-07-25T21:48

at 2021-07-25T21:48

By Agatha

at 2021-07-26T17:45

at 2021-07-26T17:45

By Kristin

at 2021-07-31T04:19

at 2021-07-31T04:19

By Isla

at 2021-08-03T03:23

at 2021-08-03T03:23

By Candice

at 2021-08-04T13:42

at 2021-08-04T13:42

By Emily

at 2021-08-06T00:32

at 2021-08-06T00:32

By Tristan Cohan

at 2021-08-06T08:05

at 2021-08-06T08:05

By Agatha

at 2021-08-09T23:36

at 2021-08-09T23:36

By Olivia

at 2021-08-10T19:59

at 2021-08-10T19:59

By Poppy

at 2021-08-12T13:26

at 2021-08-12T13:26

By Emma

at 2021-08-13T06:39

at 2021-08-13T06:39

By Edwina

at 2021-08-17T00:18

at 2021-08-17T00:18

By Audriana

at 2021-08-20T08:29

at 2021-08-20T08:29

Related Posts

持續軋空!GameStop早盤飆逾140%

By Necoo

at 2021-01-26T01:56

at 2021-01-26T01:56

持續軋空!GameStop早盤飆逾140%

By Steve

at 2021-01-26T01:27

at 2021-01-26T01:27

AMD ,教主救我多

By Steve

at 2021-01-26T00:21

at 2021-01-26T00:21

今天道瓊大跌會熔斷嗎?

By Olive

at 2021-01-26T00:09

at 2021-01-26T00:09

散戶的勝利 做空機構嗆聲慘遭軋空 這檔

By Hedda

at 2021-01-25T23:51

at 2021-01-25T23:51