富邦、永豐金大股東 加碼持股 - 股票

By Freda

at 2020-12-14T15:32

at 2020-12-14T15:32

Table of Contents

1.原文連結:https://udn.com/news/story/7252/5088236

2.原文內容:

富邦、永豐金大股東 加碼持股

2020-12-13 01:40 經濟日報 / 記者楊筱筠╱台北報導

https://uc.udn.com.tw/photo/2020/12/13/2/9275856.jpg

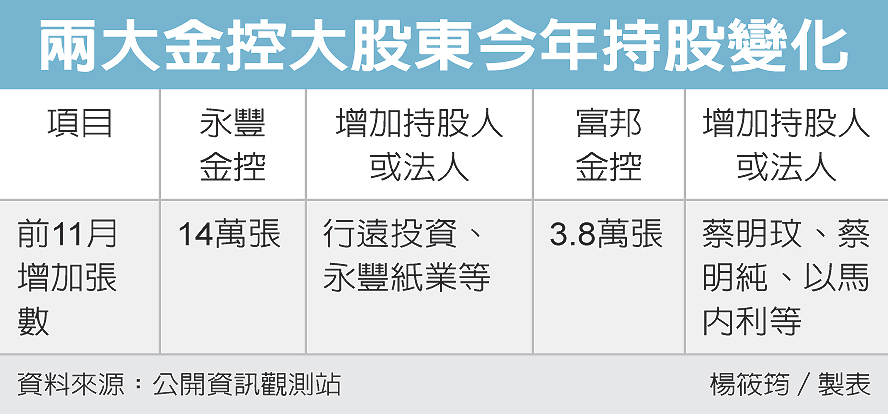

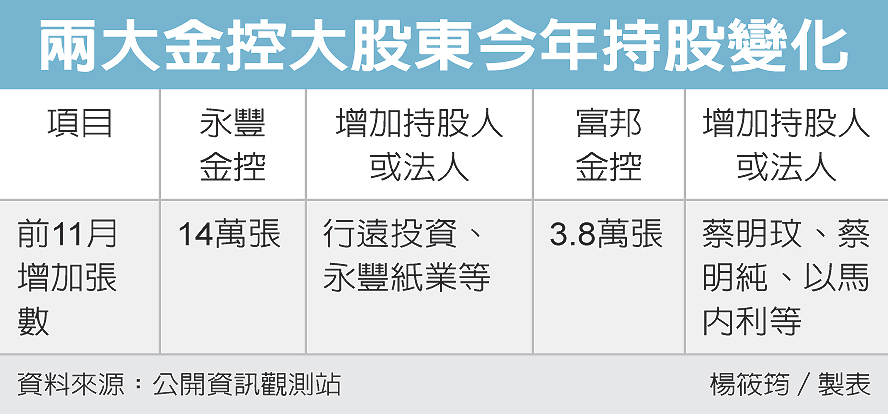

兩大金控大股東今年持股變化 圖/經濟日報提供

兩大金控大股東今年持股變化 圖/經濟日報提供

寶佳集團近年頻頻狙擊金融股,提升金融股大股東憂患意識,持續拉高自家股持股比重。

根據最新公布的上市櫃股東申報持股資料,今年以來至11月止,富邦金控、永豐金控大股

東趁著股價走低持續增持自家股票,且力道不小,今年以來對自家持股分別增加0.3個百

分點及1.26個百分點。

法人推論,這應與大股東憂患意識增加,陸續補進自家股票鞏固經營權,以避免類似寶佳

的市場派狙擊。

法人分析,金融股大股東對自家持股如果低於兩成以下,容易被市場派盯上,寶佳的實戰

也讓各金融股大股東不敢掉以輕心,趁著今年金融股受到美、台降息及疫情影響走低,大

股東拉高對自家金控持股比重,鞏固經營控制權。

統計今年1月以來至11月止,富邦金由以馬內利投資公司、蔡明玟、蔡明純、蔡楊湘薰等

持續增加對富邦金持股,總計今年以來一共增加3.8萬張,對富邦金持股比率至少增加0.3

個百分點,以富邦金今年平均股價約42元計算,增持自家股的價值至少16億元。

其中光是1、2月,以馬內利投資公司就增加15,150張富邦金,增加持股至少0.148個百分

點。該投資公司登記負責人為蔡承儒,他目前除擔任富邦育樂總經理,同時也是富邦第三

代並兼台灣大董事,此舉被市場解讀為大股東看好自家股票,陸續增加持股。

永豐金大股東何家今年到11月止,增持永豐金14萬張股票,對永豐金持股比率增加1.26個

百分點,以永豐金今年平均股價11.5元計算,增持自家股價值約當16.3億元,讓永豐金大

股東何家總持股比率在上市櫃股東申報持股資料中達20.49%。

3.心得/評論:

永豐金(2890)前11月獲利與去年相同 股價更低

何家今年逢低加碼14萬張 大股東動向具有參考性

--

2.原文內容:

富邦、永豐金大股東 加碼持股

2020-12-13 01:40 經濟日報 / 記者楊筱筠╱台北報導

https://uc.udn.com.tw/photo/2020/12/13/2/9275856.jpg

寶佳集團近年頻頻狙擊金融股,提升金融股大股東憂患意識,持續拉高自家股持股比重。

根據最新公布的上市櫃股東申報持股資料,今年以來至11月止,富邦金控、永豐金控大股

東趁著股價走低持續增持自家股票,且力道不小,今年以來對自家持股分別增加0.3個百

分點及1.26個百分點。

法人推論,這應與大股東憂患意識增加,陸續補進自家股票鞏固經營權,以避免類似寶佳

的市場派狙擊。

法人分析,金融股大股東對自家持股如果低於兩成以下,容易被市場派盯上,寶佳的實戰

也讓各金融股大股東不敢掉以輕心,趁著今年金融股受到美、台降息及疫情影響走低,大

股東拉高對自家金控持股比重,鞏固經營控制權。

統計今年1月以來至11月止,富邦金由以馬內利投資公司、蔡明玟、蔡明純、蔡楊湘薰等

持續增加對富邦金持股,總計今年以來一共增加3.8萬張,對富邦金持股比率至少增加0.3

個百分點,以富邦金今年平均股價約42元計算,增持自家股的價值至少16億元。

其中光是1、2月,以馬內利投資公司就增加15,150張富邦金,增加持股至少0.148個百分

點。該投資公司登記負責人為蔡承儒,他目前除擔任富邦育樂總經理,同時也是富邦第三

代並兼台灣大董事,此舉被市場解讀為大股東看好自家股票,陸續增加持股。

永豐金大股東何家今年到11月止,增持永豐金14萬張股票,對永豐金持股比率增加1.26個

百分點,以永豐金今年平均股價11.5元計算,增持自家股價值約當16.3億元,讓永豐金大

股東何家總持股比率在上市櫃股東申報持股資料中達20.49%。

3.心得/評論:

永豐金(2890)前11月獲利與去年相同 股價更低

何家今年逢低加碼14萬張 大股東動向具有參考性

--

Tags:

股票

All Comments

By Margaret

at 2020-12-18T14:51

at 2020-12-18T14:51

By Noah

at 2020-12-21T22:33

at 2020-12-21T22:33

By Mia

at 2020-12-25T17:48

at 2020-12-25T17:48

By Daph Bay

at 2020-12-26T08:02

at 2020-12-26T08:02

By Rachel

at 2020-12-26T18:40

at 2020-12-26T18:40

By Annie

at 2020-12-30T20:04

at 2020-12-30T20:04

By Genevieve

at 2021-01-02T15:34

at 2021-01-02T15:34

By Daniel

at 2021-01-07T15:28

at 2021-01-07T15:28

By Selena

at 2021-01-08T01:55

at 2021-01-08T01:55

By Zanna

at 2021-01-12T16:22

at 2021-01-12T16:22

By Erin

at 2021-01-13T10:52

at 2021-01-13T10:52

By George

at 2021-01-14T17:44

at 2021-01-14T17:44

By Elizabeth

at 2021-01-16T20:37

at 2021-01-16T20:37

By Emma

at 2021-01-19T20:37

at 2021-01-19T20:37

By Elma

at 2021-01-23T03:38

at 2021-01-23T03:38

By David

at 2021-01-26T15:59

at 2021-01-26T15:59

By Bethany

at 2021-01-30T18:00

at 2021-01-30T18:00

By Queena

at 2021-02-02T07:33

at 2021-02-02T07:33

By David

at 2021-02-06T20:43

at 2021-02-06T20:43

By Skylar Davis

at 2021-02-10T18:42

at 2021-02-10T18:42

By Damian

at 2021-02-12T00:47

at 2021-02-12T00:47

By Faithe

at 2021-02-15T01:42

at 2021-02-15T01:42

By Zora

at 2021-02-18T16:00

at 2021-02-18T16:00

By Madame

at 2021-02-20T09:45

at 2021-02-20T09:45

By Edward Lewis

at 2021-02-23T06:02

at 2021-02-23T06:02

By Hamiltion

at 2021-02-23T07:23

at 2021-02-23T07:23

By Edith

at 2021-02-26T03:00

at 2021-02-26T03:00

By John

at 2021-02-28T09:04

at 2021-02-28T09:04

By Rosalind

at 2021-03-02T07:17

at 2021-03-02T07:17

By Edwina

at 2021-03-07T04:11

at 2021-03-07T04:11

By Hamiltion

at 2021-03-08T17:24

at 2021-03-08T17:24

By Callum

at 2021-03-12T15:42

at 2021-03-12T15:42

By Tom

at 2021-03-16T12:32

at 2021-03-16T12:32

By Ophelia

at 2021-03-17T15:01

at 2021-03-17T15:01

By Tracy

at 2021-03-21T16:27

at 2021-03-21T16:27

By Harry

at 2021-03-26T12:02

at 2021-03-26T12:02

By Susan

at 2021-03-28T13:39

at 2021-03-28T13:39

By Isla

at 2021-04-01T17:49

at 2021-04-01T17:49

By Andrew

at 2021-04-05T03:04

at 2021-04-05T03:04

By Ethan

at 2021-04-09T19:30

at 2021-04-09T19:30

By Bethany

at 2021-04-13T14:25

at 2021-04-13T14:25

By Yedda

at 2021-04-16T18:13

at 2021-04-16T18:13

By Doris

at 2021-04-21T01:35

at 2021-04-21T01:35

By Irma

at 2021-04-24T16:32

at 2021-04-24T16:32

By Andy

at 2021-04-29T15:42

at 2021-04-29T15:42

By Ethan

at 2021-05-02T16:09

at 2021-05-02T16:09

By Mary

at 2021-05-04T08:15

at 2021-05-04T08:15

By Brianna

at 2021-05-04T10:17

at 2021-05-04T10:17

By Una

at 2021-05-07T04:20

at 2021-05-07T04:20

By William

at 2021-05-11T00:11

at 2021-05-11T00:11

By Tom

at 2021-05-11T20:13

at 2021-05-11T20:13

By Erin

at 2021-05-13T16:30

at 2021-05-13T16:30

Related Posts

ETF時代來臨?美股共同基金規模縮水13兆

By Jessica

at 2020-12-14T14:34

at 2020-12-14T14:34

緯創印度廠毀!損失16.7億台幣 千支iPh

By Kristin

at 2020-12-14T14:34

at 2020-12-14T14:34

「勞動基金弊案」揭露寶佳股市鍊金術三

By Ingrid

at 2020-12-14T14:16

at 2020-12-14T14:16

2020/12/14 盤後閒聊

By Olivia

at 2020-12-14T14:00

at 2020-12-14T14:00

富邦媒盤中股價跌破600元 寶雅超車成類

By Quanna

at 2020-12-14T13:35

at 2020-12-14T13:35